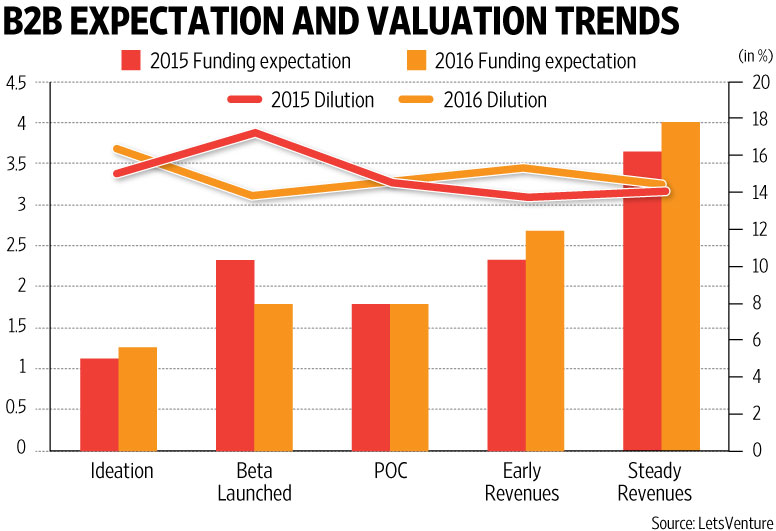

It’s not only investor appetite that has taken a turn of caution in the past few months, but entrepreneur expectations have been rationalised too, data from around 10,000 start-ups on deal-making platform LetsVenture shows.

Start-ups at ideation, beta, and proof-of-concept (POC) stages (early-stage start-ups, essentially) in the consumer sector have been seeking a lower amount when raising funds this year, compared to the last, while those making revenues are doing the opposite, given the investor-interest in companies that would turn a profit quickly.

The percentage of stake dilution that start-ups are offering has also come down in start-ups across the board.

In the business-to-business sector, however, expectations for fund-raise have largely remained the same, or even increased compared to last year, in line with the trend of investors looking to fund B2B start-ups which need far less cash to expand, many of which are even profitable, compared with cash-heavy, loss-making consumer Internet start-ups.

To be sure, entrepreneurs don’t always get the valuation they ask for or expect—the final number may look very different, but this is a fairly accurate representation of expectations.

Learn more about finance and accounting outsourcing and staffing solutions at Aristotle Consultancy.

Source – Livemint