Bank Reconciliation

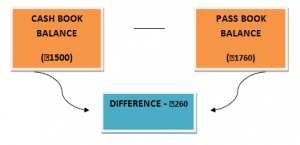

Bank reconciliation is the process of verifying the integrity of data between bank records and company’s financial records. It begins with matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement. It is therefore a necessary process which can sometimes become too long and monotonous.

When to Reconcile ?

Reconciliation should be done every month when bank statement arrives in mail. It helps in reviewing income & expenses and comparing what bank has recorded with what you have recorded. Reconciliation services are important for every business in order to keep a track of their accounts.

It is important to prepare bank reconciliation statement every month so that it does not becomea cumbersome process at the end of the year while closing the books.Many organizations who do not have relevant knowledge,consider this process a tedious task, hence, bank reconciliation services are often outsourced to a third party.

How to Reconcile?

When a bank statement arrives, start comparing transactions in your bank account to your check register of the same period. Both, the statement and the register should have same number of transactions. The purpose of preparing bank reconciliation statement is to match each line in the statement with the register.

01. Unpresented cheques

Whenever cheques are issued by the firm for payment, they are entered on the credit side of the bank column of the cash book immediately. Whereas, receiving person may not present these cheques on the same date. This causes the difference between cash book and pass book as the bank debits the firm’s account only when cheques are presented for payment.

02. Unrealized cheques

Cheques deposited into bank are debited by the firm immediately which in turn increases their bank balance. Whereas bank credits firm’s account when these cheques are actually realized, i.e., after few days. Hence, the difference remains till these cheques are cleared.

03. Dishonor of cheques

Firm credits its account as and when it deposits a cheque with the bank. However, the information of cheque being dishonored is received later to the firm. As a result, difference remains till it is debited back in the account.

04. Errors in recording transactions

While preparing cash book, firm might make few errors like missing out sale entry or other important transactions, wrong balancing, and recording transactions in other ledgers which should be recorded in cash book, etc. All these lead to the difference in balances between cash book and pass book.

05. Stale cheques

A cheque issued by a firm to a payee but not presented for payment by the payee within the local banking law of six months becomes stale. The amount already credited in the bank column of cash book of payer creates the difference.

06. Credit transfer

Sometimes, the debtors deposit money directly into the firm’s bank account without giving any notification to the firm. In this case, bank credits the firm’s account but the same is not recorded in the cash book. Therefore, difference occurs.

07. Direct debit

In some cases, firm gives instructions to bank to pay amount due directly to the payee on due date. This way, bank debits the firm’s account but the firm forgets to make an entry in the cash book.